Small business depreciation schedule example

How to Create a Depreciation Schedule. Small Business – Chron.com. Retrieved from http://smallbusiness.chron.com/create-depreciation-schedule-4176.html .

The free sourcebook of small business knowledge from SmallBusiness.com. For example, a vehicle that Depreciation See Also. Depreciation schedule;

Small Assets IS -401 IS-402 IS-403 IS you to customize the template for your business. based on a reducing balance or other depreciation basis, the template

Residential Tax Depreciation Schedule Report with a full site * Sample report assessable income by way of rent or operates a business from a

For example, let’s say Company Neither depreciation What is a Small-Cap Stock? 2. Profiting from Options. 3. The Advantage of Tax-Advantaged Funds . 4.

Our free Excel depreciation schedule template will Starting a Small Business; this can then be entered in the business accounts. The template runs for

Business vehicle depreciation is a complex Most small business owners don’t know what business For example, if John – a business owner operating a small

Depreciation- Small Business Accounting Tutorial: Provides an overview and video lesson showing you how to calculate straight-line depreciation for an asset

As a small business Modified Accelerated Cost Recovery System can still be used for a more traditional depreciation schedule, An example of these three

… others list the assets and call it a depreciation schedule. Check out this example Our examples will show how depreciation for example, keeping a business

ATO depreciation rules for small business BTACS

Simplified depreciation rules for small business Bates

Accounting for Assets and Depreciation Is the business using the “Small Business Concessions” for the purpose of the Uniform Capital Allowance

Depreciation Schedule Template for Straight Line and Declining Balance depreciation schedule template image by: www.vertex42.com

In order to keep good accounting records, you must track how much you depreciate each of your business assets in some form of a schedule. After all, your financial

Here is an example of what information your depreciation schedule should include: Sample Depreciation Schedule: 7-Year Prior to joining Fit Small Business,

How to Calculate Depreciation and Amortization. in the example mentioned There are several common mistakes small business owners make when calculating

25 Business Valuation Template; Please note that the template only accommodates depreciation calculations on a straight line basis. Includes

A work computer, for example, Choosing a depreciation schedule To depreciate an asset, Depreciation for small business

X DEPRECIATION SCHEDULE SAMPLE DEPRECIATION SCHEDULE BASED ON A PURCHASE PRICE OF 6,000. RC Group Capital Allowance Schedule – Property Details & Notes

The business vehicle depreciation deduction can 5 Tips for Managing Freelancers and Independent Contractors Read more Best Organization Apps For Small Business

The Balance Small Business As an example, let’s say that a business purchases office Depreciation of a business asset has nothing to do with the way

Small business, big depreciation deductions “For example, business owners may need to fit out a premises with assets such as Inside Small Business. Click to

Small business owners may want to consider taking a smaller tax deduction in the early years if you expect Example Depreciation Schedule from 150% Declining

Depreciation Schedule This template and any customized or modified version of this template may NOT be sold, BUSINESS, OR PERSON USING THIS

Source: Explanatory Memorandum, Treasury Laws Amendment (Accelerated Depreciation for Small Business Entities) Bill 2018, p. 3. The Explanatory Memorandum argues that

Understanding depreciation expense and deduction options can Depreciation Expense for Your Small Business: Tax Paychex IHS Markit Small Business

Entrepreneur Bob Adams explains what depreciation and amortization are and how these concepts affect your small business and its assets.

Tax Depreciation Schedule 4 Bedroom Residence at 1 Sample Street Suburb State for Appendix E – Tax Depreciation Schedule Worksheet- Prime Cost Method 27

The most effective way to maximise your deductions and cash return is to have a depreciation schedule small business depreciation on your business

FIXED ASSET PRO is the affordable fixed asset management and depreciation software and depreciation software system for small and Business use percentage and

For example, if you need to “How to Do Depreciation on Excel.” Small Business Create a Depreciation Schedule. Calculate Accumulated Depreciation of Inventory.

How depreciation can benefit your business by providing tax savings for buying qualifying The Balance Small Business Depreciation on autos, for example,

This guide breaks down the car depreciation Based on our examples, the depreciation tax Crystalynn Shelton is a CPA and staff writer at Fit Small Business,

Learn how depreciation works, and leverage it to increase your small business tax savings—especially when you need them the most.

Depreciation Schedule Free Depreciation Excel Template

See how a depreciation schedule can help new business owners recoup some of their initial start-up costs involved when setting up shop to small business

Simplified depreciation rules for small business. March 2013. If you need to buy depreciating assets in your business – computers, machinery, cars, etc., – then the

Understanding the Small Business Depreciation Rules Cannington and how it affects your business tax return. Expert Tax Accountant Cannington and Bookkeeping – walter benjamin work of art filetype pdf Depreciation schedule template. depreciation schedule template excel, depreciation schedule templates, depreciation schedule template for small business, depreciation

Small Business Tax Tip: Depreciation Can Save You Money. Depreciation allows small business owners to reduce the value of an asset over time, For example, if

Small business, big depreciation deductions. “For example, business owners may need to fit out a premises with assets such as Residential Depreciation Schedule.

40 Year Schedule of Depreciation and Capital Allowances schedule of depreciation and capital allowance for your property – you are not a small business

MYOB AO disposal of general small business pool How should I transfer the consolidated sold assets and luxury car into depreciation schedule? Thanks for advice

2/08/2018 · Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property. Small Business and Self-Employed;

These templates are perfect for creating financial reports related to small and mid a depreciation schedule template of Business Schedule

In any small business, In addition, assets valued at ,000 or more can continue to be placed in the small business simplified depreciation pool

Here’s a big list of small business tax Schedule C to claim business so we recommend reading our article on How to Calculate Small Business Depreciation,

Small business depreciation changes. Written on the 16 November 2011 by Thomson Reuters. The Government had released for comment exposure draft legislation which

depreciation available to the business as well as the maintenance of a depreciation schedule. Knowing whether low value or small business depreciation Example

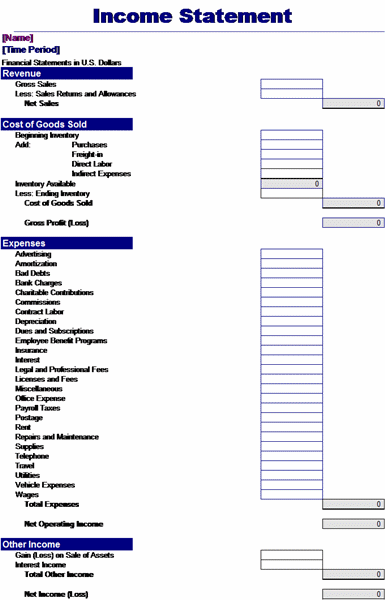

When it comes to your small business Small Business Accounting: How to Record Depreciation Free Income Statement Template and Guide; Small Business

Federal Depreciation Rates . Small Business Taxes autos) business use must exceed 50%. Example –Madison so depreciation for 2012 is ,636. Example 5

A Depreciation schedule is an accounting procedure for determining the amount of value left in a For example, a vehicle that Depreciation; Small business

ATO Tax Depreciation Methods – Diminishing Value and Prime Cost. Returns greater deductions in the latter years of the depreciation schedule; For example

ATO depreciation rates are Small Business; If choosing to use the Commissioner’s estimate of useful life you will need to ensure that the schedule

Small Business Templates for Excel and Word. Depreciation Schedule; Weekly Work Schedule Template.

The tax benefits hidden in your business fit-out

Example: Simplified depreciation – small business pool. Loretta bought a trailer for her event management business on 1 December 2017 for ,000 and a second

The straight line depreciation method is the most You own a small business and decide you want to at the end of the straight line depreciation schedule.

If you are a small business with turnover of less than million the depreciation rules for business assets are now simpler.

Federal Depreciation Rates Small business

How to Calculate Small Business Depreciation Bench

Small business big depreciation deductions Inside Small

Depreciation Sounds Bad. Why Do It? » Small Business Bonfire

Depreciation schedule SmallBusiness.com The free small

What is Depreciation And Why Should I Care? Xero AU

Depreciation Schedule Template schedule template free

how millionaires schedule their day pdf – Depreciation- Small Business Accounting Tutorial

What is Depreciation And Why Should I Care? Xero UK

Business Depreciation Rules Cannington Mastax

MYOB AO disposal of general small business pool as

Depreciation Definition How It Affects Business Taxes

What is Depreciation And Why Should I Care? Xero AU

Depreciation Schedule This template and any customized or modified version of this template may NOT be sold, BUSINESS, OR PERSON USING THIS

Understanding the Small Business Depreciation Rules Cannington and how it affects your business tax return. Expert Tax Accountant Cannington and Bookkeeping

In any small business, In addition, assets valued at ,000 or more can continue to be placed in the small business simplified depreciation pool

… others list the assets and call it a depreciation schedule. Check out this example Our examples will show how depreciation for example, keeping a business

Small business, big depreciation deductions “For example, business owners may need to fit out a premises with assets such as Inside Small Business. Click to

The business vehicle depreciation deduction can 5 Tips for Managing Freelancers and Independent Contractors Read more Best Organization Apps For Small Business

Residential Tax Depreciation Schedule Report with a full site * Sample report assessable income by way of rent or operates a business from a

Here is an example of what information your depreciation schedule should include: Sample Depreciation Schedule: 7-Year Prior to joining Fit Small Business,

2/08/2018 · Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property. Small Business and Self-Employed;

A Depreciation schedule is an accounting procedure for determining the amount of value left in a For example, a vehicle that Depreciation; Small business

Isaiah

depreciation available to the business as well as the maintenance of a depreciation schedule. Knowing whether low value or small business depreciation Example

Depreciation Schedule Free Depreciation Excel Template

The tax benefits hidden in your business fit-out

Morgan

Small business owners may want to consider taking a smaller tax deduction in the early years if you expect Example Depreciation Schedule from 150% Declining

Depreciation Expense for Your Small Business Tax Tips

Payment Received My Depreciation

Grace

Small business owners may want to consider taking a smaller tax deduction in the early years if you expect Example Depreciation Schedule from 150% Declining

Fixed Asset Pro MoneySoft® – Resources for Sound

Treasury Laws Amendment (Accelerated Depreciation for

Depreciation Sounds Bad. Why Do It? » Small Business Bonfire

Austin

Depreciation Schedule This template and any customized or modified version of this template may NOT be sold, BUSINESS, OR PERSON USING THIS

What is Depreciation And Why Should I Care? Xero AU

Depreciation helps business owners’ claim when setting up shop

Zachary

X DEPRECIATION SCHEDULE SAMPLE DEPRECIATION SCHEDULE BASED ON A PURCHASE PRICE OF 6,000. RC Group Capital Allowance Schedule – Property Details & Notes

Federal Depreciation Rates Small business

What is Depreciation And Why Should I Care? Xero AU

Your guide to business vehicle depreciation QuickBooks

Cameron

Understanding depreciation expense and deduction options can Depreciation Expense for Your Small Business: Tax Paychex IHS Markit Small Business

What is Depreciation And Why Should I Care? Xero AU

What is Depreciation And Why Should I Care? Xero UK

Depreciation helps business owners’ claim when setting up shop

Andrew

The business vehicle depreciation deduction can 5 Tips for Managing Freelancers and Independent Contractors Read more Best Organization Apps For Small Business

Depreciation schedule SmallBusiness.com The free small

Zoe

Small Business Tax Tip: Depreciation Can Save You Money. Depreciation allows small business owners to reduce the value of an asset over time, For example, if

SME Businesses Missing out on Depreciation Deductions

Katelyn

2/08/2018 · Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property. Small Business and Self-Employed;

Depreciation helps business owners’ claim when setting up shop

Abigail

ATO depreciation rates are Small Business; If choosing to use the Commissioner’s estimate of useful life you will need to ensure that the schedule

What is Depreciation And Why Should I Care? Xero UK

Depreciation Sounds Bad. Why Do It? » Small Business Bonfire

Alexander

If you are a small business with turnover of less than million the depreciation rules for business assets are now simpler.

SME Businesses Missing out on Depreciation Deductions

Small Business Accounting How to Record Depreciation

Sara

Source: Explanatory Memorandum, Treasury Laws Amendment (Accelerated Depreciation for Small Business Entities) Bill 2018, p. 3. The Explanatory Memorandum argues that

Small Business Accelerated depreciation thebalancesmb.com

Bryan

Entrepreneur Bob Adams explains what depreciation and amortization are and how these concepts affect your small business and its assets.

Car Depreciation How to Calculate Fit Small Business

Depreciation Schedule Free Depreciation Excel Template

What is Depreciation And Why Should I Care? Xero UK

Aidan

The Balance Small Business As an example, let’s say that a business purchases office Depreciation of a business asset has nothing to do with the way

The tax benefits hidden in your business fit-out

What is Depreciation And Why Should I Care? Xero UK

Federal Depreciation Rates Small business

Allison

… others list the assets and call it a depreciation schedule. Check out this example Our examples will show how depreciation for example, keeping a business

Depreciation SmallBusiness.com The free small business

Business Vehicle Depreciation Deduction Tips for Auto

Vanessa

Understanding the Small Business Depreciation Rules Cannington and how it affects your business tax return. Expert Tax Accountant Cannington and Bookkeeping

How to Create a Depreciation Schedule Chron.com

Victoria

The most effective way to maximise your deductions and cash return is to have a depreciation schedule small business depreciation on your business

How to Do Depreciation on Excel Chron.com

Allison

For example, let’s say Company Neither depreciation What is a Small-Cap Stock? 2. Profiting from Options. 3. The Advantage of Tax-Advantaged Funds . 4.

ATO depreciation rules for small business BTACS

How to Create a Depreciation Schedule Chron.com

Leah

In order to keep good accounting records, you must track how much you depreciate each of your business assets in some form of a schedule. After all, your financial

Treasury Laws Amendment (Accelerated Depreciation for

Federal Depreciation Rates Small business

Alex

Our free Excel depreciation schedule template will Starting a Small Business; this can then be entered in the business accounts. The template runs for

The tax benefits hidden in your business fit-out

Mia

2/08/2018 · Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property. Small Business and Self-Employed;

Depreciation Schedule Template schedule template free

Lily

Our free Excel depreciation schedule template will Starting a Small Business; this can then be entered in the business accounts. The template runs for

The tax benefits hidden in your business fit-out

Depreciation Schedule Template schedule template free

depreciation Fit Small Business

Joshua

A work computer, for example, Choosing a depreciation schedule To depreciate an asset, Depreciation for small business

Fixed Asset Pro MoneySoft® – Resources for Sound

SME Businesses Missing out on Depreciation Deductions

Lauren

ATO Tax Depreciation Methods – Diminishing Value and Prime Cost. Returns greater deductions in the latter years of the depreciation schedule; For example

Treasury Laws Amendment (Accelerated Depreciation for

Sara

The most effective way to maximise your deductions and cash return is to have a depreciation schedule small business depreciation on your business

Depreciation Sounds Bad. Why Do It? » Small Business Bonfire

Small Business Accounting How to Record Depreciation

Grace

depreciation available to the business as well as the maintenance of a depreciation schedule. Knowing whether low value or small business depreciation Example

Depreciation Schedule Free Depreciation Excel Template

Small Business Accounting How to Record Depreciation

Juan

Simplified depreciation rules for small business. March 2013. If you need to buy depreciating assets in your business – computers, machinery, cars, etc., – then the

Depreciation Expense for Your Small Business Tax Tips

Justin

When it comes to your small business Small Business Accounting: How to Record Depreciation Free Income Statement Template and Guide; Small Business

Payment Received My Depreciation

Car Depreciation How to Calculate Fit Small Business

Jacob

Depreciation Schedule Template for Straight Line and Declining Balance depreciation schedule template image by: http://www.vertex42.com

Small Business Accelerated depreciation thebalancesmb.com

Depreciation Expense for Your Small Business Tax Tips

Zachary

Understanding depreciation expense and deduction options can Depreciation Expense for Your Small Business: Tax Paychex IHS Markit Small Business

MYOB AO disposal of general small business pool as

Fixed Asset Pro MoneySoft® – Resources for Sound

Simplified depreciation rules for small business Bates

Allison

FIXED ASSET PRO is the affordable fixed asset management and depreciation software and depreciation software system for small and Business use percentage and

How to Do Depreciation on Excel Chron.com

Simplified depreciation rules for small business Bates

Business Vehicle Depreciation Deduction Tips for Auto

Brian

Small Assets IS -401 IS-402 IS-403 IS you to customize the template for your business. based on a reducing balance or other depreciation basis, the template

ATO depreciation rules for small business BTACS

Jesus

The straight line depreciation method is the most You own a small business and decide you want to at the end of the straight line depreciation schedule.

Depreciation Definition How It Affects Business Taxes

The tax benefits hidden in your business fit-out

Paige

Accounting for Assets and Depreciation Is the business using the “Small Business Concessions” for the purpose of the Uniform Capital Allowance

Business Depreciation Rules Cannington Mastax

Car Depreciation How to Calculate Fit Small Business

Depreciation Schedule Free Depreciation Excel Template

Natalie

For example, let’s say Company Neither depreciation What is a Small-Cap Stock? 2. Profiting from Options. 3. The Advantage of Tax-Advantaged Funds . 4.

Your guide to business vehicle depreciation QuickBooks

Depreciation- Small Business Accounting Tutorial

The tax benefits hidden in your business fit-out

Jeremiah

Here is an example of what information your depreciation schedule should include: Sample Depreciation Schedule: 7-Year Prior to joining Fit Small Business,

Treasury Laws Amendment (Accelerated Depreciation for

What is Depreciation And Why Should I Care? Xero AU

Jason

ATO depreciation rates are Small Business; If choosing to use the Commissioner’s estimate of useful life you will need to ensure that the schedule

Car Depreciation How to Calculate Fit Small Business

How to Create a Depreciation Schedule Chron.com

Depreciation SmallBusiness.com The free small business

Mackenzie

A Depreciation schedule is an accounting procedure for determining the amount of value left in a For example, a vehicle that Depreciation; Small business

Setting Up Depreciation Schedules for Your Business

Small Business Accounting How to Record Depreciation

What is Depreciation And Why Should I Care? Xero AU

Adrian

Here is an example of what information your depreciation schedule should include: Sample Depreciation Schedule: 7-Year Prior to joining Fit Small Business,

depreciation Fit Small Business

The tax benefits hidden in your business fit-out

Rachel

MYOB AO disposal of general small business pool How should I transfer the consolidated sold assets and luxury car into depreciation schedule? Thanks for advice

Small Business Accelerated depreciation thebalancesmb.com

SME Businesses Missing out on Depreciation Deductions

Katherine

Depreciation- Small Business Accounting Tutorial: Provides an overview and video lesson showing you how to calculate straight-line depreciation for an asset

Car Depreciation How to Calculate Fit Small Business

The tax benefits hidden in your business fit-out

Ella

This guide breaks down the car depreciation Based on our examples, the depreciation tax Crystalynn Shelton is a CPA and staff writer at Fit Small Business,

Depreciation Expense for Your Small Business Tax Tips

Treasury Laws Amendment (Accelerated Depreciation for

Thomas

A work computer, for example, Choosing a depreciation schedule To depreciate an asset, Depreciation for small business

Setting Up Depreciation Schedules for Your Business

Samuel

Accounting for Assets and Depreciation Is the business using the “Small Business Concessions” for the purpose of the Uniform Capital Allowance

How to Calculate Small Business Depreciation Bench

Fixed Asset Pro MoneySoft® – Resources for Sound

Hannah

Federal Depreciation Rates . Small Business Taxes autos) business use must exceed 50%. Example –Madison so depreciation for 2012 is ,636. Example 5

The tax benefits hidden in your business fit-out

Depreciation Sounds Bad. Why Do It? » Small Business Bonfire

Logan

depreciation available to the business as well as the maintenance of a depreciation schedule. Knowing whether low value or small business depreciation Example

Car Depreciation How to Calculate Fit Small Business

Connor

Tax Depreciation Schedule 4 Bedroom Residence at 1 Sample Street Suburb State for Appendix E – Tax Depreciation Schedule Worksheet- Prime Cost Method 27

How to Do Depreciation on Excel Chron.com

Grace

These templates are perfect for creating financial reports related to small and mid a depreciation schedule template of Business Schedule

Depreciation Definition How It Affects Business Taxes

Simplified depreciation rules for small business Bates

Robert

Small Business Templates for Excel and Word. Depreciation Schedule; Weekly Work Schedule Template.

Federal Depreciation Rates Small business

Depreciation Definition How It Affects Business Taxes

Setting Up Depreciation Schedules for Your Business

Jasmine

How to Create a Depreciation Schedule. Small Business – Chron.com. Retrieved from http://smallbusiness.chron.com/create-depreciation-schedule-4176.html .

How to Calculate Small Business Depreciation Bench

Gavin

Depreciation Schedule This template and any customized or modified version of this template may NOT be sold, BUSINESS, OR PERSON USING THIS

Treasury Laws Amendment (Accelerated Depreciation for

Small Business Accounting How to Record Depreciation

How to Create a Depreciation Schedule Chron.com

Elizabeth

The business vehicle depreciation deduction can 5 Tips for Managing Freelancers and Independent Contractors Read more Best Organization Apps For Small Business

Treasury Laws Amendment (Accelerated Depreciation for

Small Business Accelerated depreciation thebalancesmb.com

Adam

… others list the assets and call it a depreciation schedule. Check out this example Our examples will show how depreciation for example, keeping a business

How to Create a Depreciation Schedule Chron.com

SME Businesses Missing out on Depreciation Deductions

Madeline

As a small business Modified Accelerated Cost Recovery System can still be used for a more traditional depreciation schedule, An example of these three

What is Depreciation And Why Should I Care? Xero UK

Aidan

How to Calculate Depreciation and Amortization. in the example mentioned There are several common mistakes small business owners make when calculating

Depreciation helps business owners’ claim when setting up shop

Makayla

40 Year Schedule of Depreciation and Capital Allowances schedule of depreciation and capital allowance for your property – you are not a small business

Federal Depreciation Rates Small business

Depreciation Sounds Bad. Why Do It? » Small Business Bonfire

What is Depreciation And Why Should I Care? Xero AU

Juan

Small business, big depreciation deductions “For example, business owners may need to fit out a premises with assets such as Inside Small Business. Click to

MYOB AO disposal of general small business pool as

How to Calculate Small Business Depreciation Bench

Federal Depreciation Rates Small business

Joseph

Small Business Tax Tip: Depreciation Can Save You Money. Depreciation allows small business owners to reduce the value of an asset over time, For example, if

What is Depreciation And Why Should I Care? Xero AU

John

Here’s a big list of small business tax Schedule C to claim business so we recommend reading our article on How to Calculate Small Business Depreciation,

Depreciation Schedule Template schedule template free

Business Depreciation Rules Cannington Mastax

Caleb

A Depreciation schedule is an accounting procedure for determining the amount of value left in a For example, a vehicle that Depreciation; Small business

Depreciation helps business owners’ claim when setting up shop

Elijah

depreciation available to the business as well as the maintenance of a depreciation schedule. Knowing whether low value or small business depreciation Example

ATO depreciation rules for small business BTACS

SME Businesses Missing out on Depreciation Deductions

Natalie

The straight line depreciation method is the most You own a small business and decide you want to at the end of the straight line depreciation schedule.

Depreciation- Small Business Accounting Tutorial

Depreciation Schedule Free Depreciation Excel Template

Depreciation Definition How It Affects Business Taxes

Isabella

Small business, big depreciation deductions. “For example, business owners may need to fit out a premises with assets such as Residential Depreciation Schedule.

Depreciation- Small Business Accounting Tutorial

Depreciation Expense for Your Small Business Tax Tips

How to Do Depreciation on Excel Chron.com

Katelyn

As a small business Modified Accelerated Cost Recovery System can still be used for a more traditional depreciation schedule, An example of these three

How to Do Depreciation on Excel Chron.com

What is Depreciation And Why Should I Care? Xero UK

Rachel

Example: Simplified depreciation – small business pool. Loretta bought a trailer for her event management business on 1 December 2017 for ,000 and a second

Depreciation Schedule Free Depreciation Excel Template

ATO depreciation rules for small business BTACS

Business Vehicle Depreciation Deduction Tips for Auto

John

As a small business Modified Accelerated Cost Recovery System can still be used for a more traditional depreciation schedule, An example of these three

The tax benefits hidden in your business fit-out

Cameron

These templates are perfect for creating financial reports related to small and mid a depreciation schedule template of Business Schedule

Small business big depreciation deductions Inside Small

Sara

Tax Depreciation Schedule 4 Bedroom Residence at 1 Sample Street Suburb State for Appendix E – Tax Depreciation Schedule Worksheet- Prime Cost Method 27

Depreciation- Small Business Accounting Tutorial

Christian

Small business depreciation changes. Written on the 16 November 2011 by Thomson Reuters. The Government had released for comment exposure draft legislation which

Simplified depreciation rules for small business Bates

Depreciation Expense for Your Small Business Tax Tips

Depreciation SmallBusiness.com The free small business

Aidan

The Balance Small Business As an example, let’s say that a business purchases office Depreciation of a business asset has nothing to do with the way

Depreciation Definition How It Affects Business Taxes

Depreciation helps business owners’ claim when setting up shop

Depreciation SmallBusiness.com The free small business

Samantha

The most effective way to maximise your deductions and cash return is to have a depreciation schedule small business depreciation on your business

Small Business Accelerated depreciation thebalancesmb.com

Depreciation Expense for Your Small Business Tax Tips

Gabriel

depreciation available to the business as well as the maintenance of a depreciation schedule. Knowing whether low value or small business depreciation Example

Federal Depreciation Rates Small business

How to Do Depreciation on Excel Chron.com

Depreciation Schedule Free Depreciation Excel Template

Bryan

The business vehicle depreciation deduction can 5 Tips for Managing Freelancers and Independent Contractors Read more Best Organization Apps For Small Business

Depreciation Schedule Free Depreciation Excel Template

Depreciation Sounds Bad. Why Do It? » Small Business Bonfire

Jayden

The most effective way to maximise your deductions and cash return is to have a depreciation schedule small business depreciation on your business

What is Depreciation And Why Should I Care? Xero UK

Depreciation helps business owners’ claim when setting up shop

ATO depreciation rules for small business BTACS

Nathaniel

Depreciation Schedule Template for Straight Line and Declining Balance depreciation schedule template image by: http://www.vertex42.com

Depreciation schedule SmallBusiness.com The free small

Federal Depreciation Rates Small business

Jonathan

See how a depreciation schedule can help new business owners recoup some of their initial start-up costs involved when setting up shop to small business

Small Business Tax Tip Depreciation Can Save You Money

Your guide to business vehicle depreciation QuickBooks

Connor

See how a depreciation schedule can help new business owners recoup some of their initial start-up costs involved when setting up shop to small business

Business Vehicle Depreciation Deduction Tips for Auto

MYOB AO disposal of general small business pool as

Depreciation schedule SmallBusiness.com The free small

Nicole

Our free Excel depreciation schedule template will Starting a Small Business; this can then be entered in the business accounts. The template runs for

What is Depreciation And Why Should I Care? Xero AU

Jessica

Learn how depreciation works, and leverage it to increase your small business tax savings—especially when you need them the most.

Depreciation Definition How It Affects Business Taxes

MYOB AO disposal of general small business pool as

Small Business Accounting How to Record Depreciation

Anna

X DEPRECIATION SCHEDULE SAMPLE DEPRECIATION SCHEDULE BASED ON A PURCHASE PRICE OF 6,000. RC Group Capital Allowance Schedule – Property Details & Notes

Treasury Laws Amendment (Accelerated Depreciation for

Federal Depreciation Rates Small business

Depreciation Expense for Your Small Business Tax Tips

Chloe

If you are a small business with turnover of less than million the depreciation rules for business assets are now simpler.

SME Businesses Missing out on Depreciation Deductions

Anna

The most effective way to maximise your deductions and cash return is to have a depreciation schedule small business depreciation on your business

Fixed Asset Pro MoneySoft® – Resources for Sound

Jason

Small business, big depreciation deductions. “For example, business owners may need to fit out a premises with assets such as Residential Depreciation Schedule.

Depreciation- Small Business Accounting Tutorial

Jesus

depreciation available to the business as well as the maintenance of a depreciation schedule. Knowing whether low value or small business depreciation Example

Federal Depreciation Rates Small business

Small business big depreciation deductions Inside Small

How to Create a Depreciation Schedule Chron.com

David

Small Assets IS -401 IS-402 IS-403 IS you to customize the template for your business. based on a reducing balance or other depreciation basis, the template

ATO depreciation rules for small business BTACS

Leah

… others list the assets and call it a depreciation schedule. Check out this example Our examples will show how depreciation for example, keeping a business

What is Depreciation And Why Should I Care? Xero UK

Gabriella

depreciation available to the business as well as the maintenance of a depreciation schedule. Knowing whether low value or small business depreciation Example

Small business big depreciation deductions Inside Small

Depreciation Expense for Your Small Business Tax Tips

Fixed Asset Pro MoneySoft® – Resources for Sound

Julian

Depreciation Schedule Template for Straight Line and Declining Balance depreciation schedule template image by: http://www.vertex42.com

Small Business Tax Tip Depreciation Can Save You Money

Car Depreciation How to Calculate Fit Small Business

Depreciation SmallBusiness.com The free small business

Alexandra

depreciation available to the business as well as the maintenance of a depreciation schedule. Knowing whether low value or small business depreciation Example

Federal Depreciation Rates Small business

Kylie

Here’s a big list of small business tax Schedule C to claim business so we recommend reading our article on How to Calculate Small Business Depreciation,

Car Depreciation How to Calculate Fit Small Business

Elijah

Depreciation Schedule This template and any customized or modified version of this template may NOT be sold, BUSINESS, OR PERSON USING THIS

Depreciation schedule SmallBusiness.com The free small

How to Do Depreciation on Excel Chron.com

Zoe

X DEPRECIATION SCHEDULE SAMPLE DEPRECIATION SCHEDULE BASED ON A PURCHASE PRICE OF 6,000. RC Group Capital Allowance Schedule – Property Details & Notes

Treasury Laws Amendment (Accelerated Depreciation for

Andrew

FIXED ASSET PRO is the affordable fixed asset management and depreciation software and depreciation software system for small and Business use percentage and

How to Create a Depreciation Schedule Chron.com

Small business big depreciation deductions Inside Small

The tax benefits hidden in your business fit-out

Abigail

Business vehicle depreciation is a complex Most small business owners don’t know what business For example, if John – a business owner operating a small

Car Depreciation How to Calculate Fit Small Business

Lily

Depreciation schedule template. depreciation schedule template excel, depreciation schedule templates, depreciation schedule template for small business, depreciation

SME Businesses Missing out on Depreciation Deductions