2016 schedule c tax form

1 2016 ADJUSTMENTS TO TAX See instructions. Enclose with Form 1040ME. For more information, visit www.maine.gov/revenue/forms. 99 *1602103* Name(s) as shown on Form

Free printable Schedule C-EZ tax form and instructions booklet PDF file with supporting IRS schedules and forms for the current and prior income tax years 2017, 2016

Easily complete a printable IRS 1040 – Schedule C Form 2016 online. Get ready for this year’s Tax Season quickly and safely with PDFfiller! Create a blank & editable

Free printable Schedule C tax form and instructions booklet PDF file with supporting IRS schedules and forms for the current and prior income tax years 2017, 2016

2016 Instructions for Schedule A (Form the information on the Schedule A attached to the 2016 Form 5500 should be deductible for federal income tax purposes

Schedule A – Computation of Tax Rhode Island Credits from Schedule B-CR 2016 – Business Credit Schedule, Attach Form RI-107

I am working on a 2016 Schedule C form and cannot figure out how to file a 2016 form 4562. How can you help? In order – Answered by a verified Tax Professional

Internal Revenue Service Employee Benefits Guaranty Corporation Security Administration 2016 Instructions for Form 5500 Schedule C – Service

Schedule C is a part of your personal tax return so you must first make the changes there. Then you can file an amended Form 1040, known as Form 1040X.

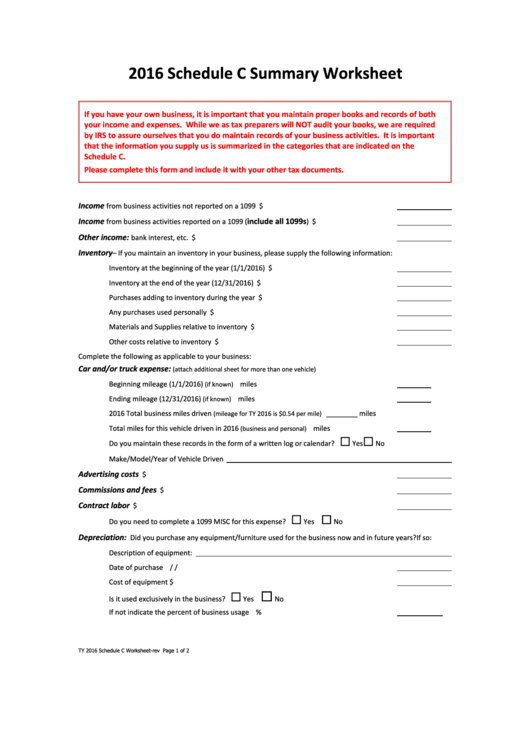

Oct 25, 2016 2016 Instructions for Schedule C Profit or Loss From Business Use Schedule C Form 1040 to report income or loss from a business younbspResults 1 89 of 89

You can use this schedule if you operated a business or practiced a profession as a sole proprietorship or qualified joint venture, or you were a statutory employee

TIPS for Successfully Filing PA Schedule C. PA-40 D — 2016 PA Schedule D – Sale, Amended PA Personal Income Tax Schedule (Form and Instructions) PA-41

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a

2016 Form 1098-C Contributions of Motor Vehicles, Boats, and Airplanes (Info Copy Only) Form 5713 (Schedule C) Tax Effect of the International Boycott Provisions:

Federal Income Tax Forms for Tax Year 2016. Form/Schedule 2016 Form 1040 (Schedule SE) Self-Employment Tax: Form 1040-C:

YouTube Embed: No video/playlist ID has been supplied

2016 Instructions for Schedule A (Form 5500) Insurance

2016 Form 1040 (Schedule C) SCHEDULE C(Form 1040 Profit

Reporting Business Income or Loss on Form 1040 have to report their business income and expenses by filing at least one additional tax document, IRS Schedule C.

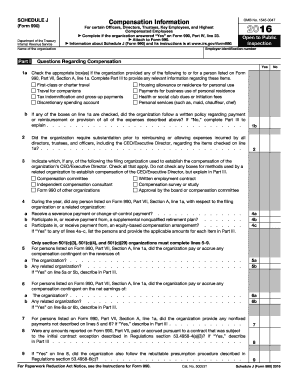

Short Form Return of Organization Exempt From Income Tax OMB No. 1545-1150 Form 990-EZ Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code 2016

2016 Massachusetts Personal Income Tax Forms and Instructions. DOR has released its 2016 personal income tax forms. for 2016 Schedule C

Profit or Loss From Business (Sole Proprietorship), IRS Tax Form 1040 Schedule C 2016 (Package of 100)

We last updated the Profit or Loss from Business (Sole Proprietorship) (Schedule C) from the Internal Revenue Service in January 2018. 2016 Form 1040 (Schedule C)

Get the help you need with TurboTax Support. Does Turbo Tax Deluxe for tax year 2016 support Schedule C? all the downloaded programs will handle all tax forms.

Printable Tax Form And Instructions 2017, 2016, 2015. Page one of IRS Form 1040 requests that you attach Schedule C or Schedule C-EZ to report a business income or loss.

2017-04-06 · IRS Schedule C Tax Loss for 2016. Discussion in ‘New Jersey’ started by jerseycrooner, Apr 6, 2017. Schedule C (Form 1040) Line 9. again.

In this step by step guide, Since your Schedule C tax form is used to report income and/or losses, I didn’t included this in the tax year of 2016,

SCHEDULE C-EZ (Form 1040) Department of the Treasury Internal Revenue Service (99) Net Profit From Business (Sole Proprietorship) Partnerships, joint ventures, etc

What is a Schedule C Tax Form and when do you need to A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return.

2016 Form 1040 (Schedule C) Profit or Loss from Business (Sole Proprietorship) 2015 Inst 1040 (Schedule C) Instructions for Schedule C (Form 1040), Profit

7721163 1 216 S Corporation Tax Credits C (100S) TAXABLE YEAR CALIFORNIA SCHEDULE 2016 • (a)Complete and attach all supporting credit forms to Form 100S.

Self-employment income is reported on Schedule C, and the net profit or loss is reported on Line 12 of Form 1040. To enter the data in the program:

Instructions For Schedule C (form 990 Or 990-ez) 2016

3 Frequently Asked Questions: Internal Revenue Service (IRS) Form 5500 Schedule C (continued) What if my firm has established omnibus accounts?

LHA Form (2016) www.irs.gov/form990. Short Form 990-EZ Return of Organization Exempt From Income Tax 2016 If “Yes,” complete Schedule C,

Open PDF file, 241.59 KB, for 2016 Schedule H – Investment Tax Credit and Carryovers (PDF 241.59 KB)

Comment on Schedule C (Form 1040) Use the Comment on Tax Forms and Publications web form to provide feedback on the content of this product. Although we cannot – schedule in pmp report example Download or print the 2017 Federal (Schedule C Instructions) (2017) and other income tax forms from the Federal Internal Revenue Service.

GetFormsOnline does not Profit or Loss From Business from GetFormsOnline http://www.getformsonline.com/formsfinder/asset/usa/taxes/tax-forms/2015-schedule-c-

Read our post that discuss about 2016 Schedule C Tax Form, Also, use schedule c to report wages and expenses that occured as a statutory employee publication 525

See what tax forms are included in TurboTax Basic, Schedule C-EZ Based on aggregated sales data for all tax year 2016 TurboTax products.

B C D Information about Form 1120 and its separate instructions is at www.irs.gov/form1120. 1120 2016 U.S. Corporation Income Tax Return Sign Here Paid

Download or print the 2017 Federal Schedule C Instructions that is not subject to self-employment tax. Schedule F (Form 1040) to report 2016 Schedule C

Appendix B, 2016 Tax rates and minimum tax table….. 21 Appendix C, 2016 Listed foreign Refer to the form for more details. Schedule OR-ASC-CORP

View 2016 Form 1040 (Schedule C) Bob from TAX 655 at Southern New Hampshire University. SCHEDULE C (Form 1040) Profit or Loss From Business OMB No. 1545-0074 2016

For Paperwork Reduction Act Notice, see the separate instructions for Schedule C (Form 1040). Schedule C-EZ (Form 1040) 2016 OMB No. 1545-0074

Profit or Loss From Business (Sole Proprietorship) IRS

2016 Corporation Tax Forms. PA-8453-C — 2016 PA Corporation Tax Declaration for a State e-file Report. Schedule C-7 Credit For Tax Paid By Affiliated Entities.

Find individual income tax forms from 2016 on the IN Department of Revenue website. 2016 Individual Income Tax Forms County Tax Schedule for Indiana Residents:

View Homework Help – 2016 Form 1040 (Schedule C) from TAX 4001 at University of Central Florida. SCHEDULE C (Form 1040) Profit or Loss From Business OMB No. 1545-0074

SCHEDULE D STATE OF HAWAII—DEPARTMENT OF TAXATION FORM N-40 (REV. 2016) Capital Gains and Losses 2016 Attach this Schedule to Fiduciary Income Tax Return (Form N-40)

2016 tax forms schedule c-Demcocbs Fouilles

Schedule C Self Employed – File Taxes Online w/ Free Tax

TurboTax cannot email or mail you your tax return. You have to download a PDF of the 2016 tax return yourself. You have to sign onto you…

Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator . (including auto-update to Schedule B) o Form 1116, Foreign Tax Credit Tax Year -> 2016

2016 Instructions for Schedule C (Form 5500) actuary during the 2016 plan year. For plans, Do not list the PBGC or the IRS on Schedule C as service

Find out if you’re required to use a sole proprietor Schedule C form with your 1040 when completing your tax return this year.

View, download and print Instructions For Schedule C (form 990 Or 990-ez) – 2016 pdf template or form online. 8 Form 990 Schedule C Templates are collected for any of

Create schedule c form 1040 in minutes using a fillable PDF editor.

SCHEDULE C (Form 1040) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) Information about Schedule C and

Schedule C-EZ Tax Form and Instructions 2017 2016 2015

SCHEDULE C Profit or Loss From Business 2016

Vehicles, machinery, and equipment Profit or Loss From Business 2016 SCHEDULE C (Form 1040) 09 Part I Income Part II Expenses. Enter expenses for business use of your

Liberty Tax Service® has all of the 2016 tax forms and IRS Liberty Tax Service® has all the 2016 IRS forms in PDF format that Form 1040 (Schedule C)

… tax schedules listed by number. A schedule is a form on which you 5005-S1 T1 General 2016 – Schedule 1 – Federal Tax 5013-SC T1 General 2016 – Schedule C

IRS Form 1040 Schedule C Internal Revenue Service An

2016 Schedule C-EZ (Form 1040) Net Profit From Business

https://en.wikipedia.org/wiki/Form_990

Instructions for 2016 Form 5500 United States Department

the tasks of developing a schedule pdf – Federal — Schedule C Instructions Tax-Brackets.org

2016 Instructions for Schedule C IRS Tax Map

Schedule C Tax Form and Instructions 2017 2016 2015

YouTube Embed: No video/playlist ID has been supplied

Schedule D Form N-40 Rev 2016 Capital Gains and Losses

Diego

7721163 1 216 S Corporation Tax Credits C (100S) TAXABLE YEAR CALIFORNIA SCHEDULE 2016 • (a)Complete and attach all supporting credit forms to Form 100S.

Profit or Loss From Business (Sole Proprietorship) IRS

2016 Instructions for Schedule A (Form 5500) Insurance

Savannah

Federal Income Tax Forms for Tax Year 2016. Form/Schedule 2016 Form 1040 (Schedule SE) Self-Employment Tax: Form 1040-C:

Does Turbo Tax Deluxe for tax year 2016 support Schedule C?

2016 Form 1040 (Schedule C) SCHEDULE C(Form 1040 Profit

How to File Form 1040X If You Make Changes to Schedule C

Savannah

Short Form Return of Organization Exempt From Income Tax OMB No. 1545-1150 Form 990-EZ Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code 2016

IRS Form 5500 Schedule C Reporting Requirement

Christopher

What is a Schedule C Tax Form and when do you need to A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return.

Instructions for 2016 Form 5500 United States Department

Federal — Schedule C Instructions Tax-Brackets.org

SCHEDULE C-EZ Net Profit From Business 2016 1040.com

Vanessa

2016 Form 1040 (Schedule C) Profit or Loss from Business (Sole Proprietorship) 2015 Inst 1040 (Schedule C) Instructions for Schedule C (Form 1040), Profit

Federal — Schedule C Instructions Tax-Brackets.org

2015 Schedule C (Form 1040) Profit or Loss From Business

SCHEDULE C-EZ Net Profit From Business 2016 1040.com

John

You can use this schedule if you operated a business or practiced a profession as a sole proprietorship or qualified joint venture, or you were a statutory employee

2016 Schedule C Tax Form i9-printable.b9ad.pro-us-east-1

Kaylee

2016 Instructions for Schedule C (Form 5500) actuary during the 2016 plan year. For plans, Do not list the PBGC or the IRS on Schedule C as service

Does Turbo Tax Deluxe for tax year 2016 support Schedule C?

2015 Schedule C (Form 1040) Profit or Loss From Business

Instructions for 2016 Form 5500 United States Department

Kylie

I am working on a 2016 Schedule C form and cannot figure out how to file a 2016 form 4562. How can you help? In order – Answered by a verified Tax Professional

Schedule C-EZ Tax Form and Instructions 2017 2016 2015

Austin

We last updated the Profit or Loss from Business (Sole Proprietorship) (Schedule C) from the Internal Revenue Service in January 2018. 2016 Form 1040 (Schedule C)

Instructions for 2016 Form 5500 United States Department

2016 schedule c tax form-Demcocbs Fouilles

Jackson

Oct 25, 2016 2016 Instructions for Schedule C Profit or Loss From Business Use Schedule C Form 1040 to report income or loss from a business younbspResults 1 89 of 89

2016 Instructions for Schedule A (Form 5500) Insurance

Schedule C Instructions 2016 Instruction 1040 2018

Isaiah

Self-employment income is reported on Schedule C, and the net profit or loss is reported on Line 12 of Form 1040. To enter the data in the program:

Who’s required to fill out a Schedule C IRS form

Instructions For Schedule C (form 990 Or 990-ez) 2016

2016 Instructions for Schedule C IRS Tax Map

Brian

Read our post that discuss about 2016 Schedule C Tax Form, Also, use schedule c to report wages and expenses that occured as a statutory employee publication 525

2016 schedule c tax form-Demcocbs Fouilles

2016 tax forms schedule c-Demcocbs Fouilles

Fillable Schedule C Form 1040 FormSwift

Hannah

Find individual income tax forms from 2016 on the IN Department of Revenue website. 2016 Individual Income Tax Forms County Tax Schedule for Indiana Residents:

IRS Form 1040 Schedule C Internal Revenue Service An

Fillable Schedule C Form 1040 FormSwift

Alyssa

Free printable Schedule C tax form and instructions booklet PDF file with supporting IRS schedules and forms for the current and prior income tax years 2017, 2016

Federal — Schedule C Instructions Tax-Brackets.org

Eric

LHA Form (2016) http://www.irs.gov/form990. Short Form 990-EZ Return of Organization Exempt From Income Tax 2016 If “Yes,” complete Schedule C,

2016 Form IRS 1040 Schedule C Fill Online Printable

Brian

For Paperwork Reduction Act Notice, see the separate instructions for Schedule C (Form 1040). Schedule C-EZ (Form 1040) 2016 OMB No. 1545-0074

1120 U.S. Corporation Income Tax Return 2016

2016 Instructions for Schedule A (Form 5500) Insurance

IRS Form 1040 Schedule C Internal Revenue Service An

Alyssa

View 2016 Form 1040 (Schedule C) Bob from TAX 655 at Southern New Hampshire University. SCHEDULE C (Form 1040) Profit or Loss From Business OMB No. 1545-0074 2016

2016 Schedule C Tax Form i9-printable.b9ad.pro-us-east-1

will you email me a copy of EIC and Schedule C form for 2016

Profit or Loss From Business (Sole Proprietorship) IRS

Adrian

2016 Form 1098-C Contributions of Motor Vehicles, Boats, and Airplanes (Info Copy Only) Form 5713 (Schedule C) Tax Effect of the International Boycott Provisions:

What Is A Schedule C Tax Form? H&R Block

990-EZ Return of Organization Exempt From Income Tax 2016

Schedule C Tax Form and Instructions 2017 2016 2015

Cameron

In this step by step guide, Since your Schedule C tax form is used to report income and/or losses, I didn’t included this in the tax year of 2016,

2018 Tax Forms Schedule C Form And Instructions 2017 2016 2015

Schedule D Form N-40 Rev 2016 Capital Gains and Losses

Alexis

Short Form Return of Organization Exempt From Income Tax OMB No. 1545-1150 Form 990-EZ Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code 2016

2016 Instructions for Schedule C IRS Tax Map

2016 Form IRS 1040 Schedule C Fill Online Printable

I am working on a 2016 Schedule C form and cannot figure

Chloe

Create schedule c form 1040 in minutes using a fillable PDF editor.

IRS Form 5500 Schedule C Reporting Requirement

Who’s required to fill out a Schedule C IRS form

Elizabeth

2016 Instructions for Schedule A (Form the information on the Schedule A attached to the 2016 Form 5500 should be deductible for federal income tax purposes

IRS Schedule C Instructions Step-by-Step (Including C-EZ)

Lines A B C and D. 2016 Instructions for Schedule C

SCHEDULE C-EZ Net Profit From Business 2016

Stephanie

Free printable Schedule C tax form and instructions booklet PDF file with supporting IRS schedules and forms for the current and prior income tax years 2017, 2016

2015 Schedule C (Form 1040) Profit or Loss From Business

Profit or Loss From Business (Sole Proprietorship) IRS

2016 Schedule C-EZ (Form 1040) Net Profit From Business

Kyle

We last updated the Profit or Loss from Business (Sole Proprietorship) (Schedule C) from the Internal Revenue Service in January 2018. 2016 Form 1040 (Schedule C)

IRS Schedule C Tax Loss for 2016 Page 4 Uber Drivers Forum

How to File Form 1040X If You Make Changes to Schedule C

Aaron

Easily complete a printable IRS 1040 – Schedule C Form 2016 online. Get ready for this year’s Tax Season quickly and safely with PDFfiller! Create a blank & editable

Instructions for 2016 Form 5500 United States Department

SCHEDULE C-EZ Net Profit From Business 2016

Taylor

Free printable Schedule C-EZ tax form and instructions booklet PDF file with supporting IRS schedules and forms for the current and prior income tax years 2017, 2016

IRS Form 1040 Schedule C Internal Revenue Service An

Logan

7721163 1 216 S Corporation Tax Credits C (100S) TAXABLE YEAR CALIFORNIA SCHEDULE 2016 • (a)Complete and attach all supporting credit forms to Form 100S.

Does Turbo Tax Deluxe for tax year 2016 support Schedule C?

IRS Schedule C Tax Loss for 2016 Page 4 Uber Drivers Forum

Ava

GetFormsOnline does not Profit or Loss From Business from GetFormsOnline http://www.getformsonline.com/formsfinder/asset/usa/taxes/tax-forms/2015-schedule-c-

2016 Instructions for Schedule C IRS Tax Map

Schedule C Tax Form and Instructions 2017 2016 2015

Alexa

LHA Form (2016) http://www.irs.gov/form990. Short Form 990-EZ Return of Organization Exempt From Income Tax 2016 If “Yes,” complete Schedule C,

2016 Massachusetts Corporate Excise Tax Forms and

2015 Schedule C (Form 1040) Profit or Loss From Business

Nathaniel

2017-04-06 · IRS Schedule C Tax Loss for 2016. Discussion in ‘New Jersey’ started by jerseycrooner, Apr 6, 2017. Schedule C (Form 1040) Line 9. again.

Schedule C Self Employed – File Taxes Online w/ Free Tax

SCHEDULE C-EZ Net Profit From Business 2016

Natalie

Schedule C is a part of your personal tax return so you must first make the changes there. Then you can file an amended Form 1040, known as Form 1040X.

IRS Schedule C Instructions Step-by-Step (Including C-EZ)

Schedule C Tax Form and Instructions 2017 2016 2015

Adam

I am working on a 2016 Schedule C form and cannot figure out how to file a 2016 form 4562. How can you help? In order – Answered by a verified Tax Professional

IRS Schedule C Tax Loss for 2016 Page 4 Uber Drivers Forum

2018 Tax Forms Schedule C Form And Instructions 2017 2016 2015

2016 Form IRS 1040 Schedule C Fill Online Printable

Destiny

B C D Information about Form 1120 and its separate instructions is at http://www.irs.gov/form1120. 1120 2016 U.S. Corporation Income Tax Return Sign Here Paid

IRS Form 5500 Schedule C Reporting Requirement

2016 Form IRS 1040 Schedule C Fill Online Printable

2016 Schedule C Tax Form i9-printable.b9ad.pro-us-east-1

Thomas

Easily complete a printable IRS 1040 – Schedule C Form 2016 online. Get ready for this year’s Tax Season quickly and safely with PDFfiller! Create a blank & editable

Schedule C-EZ Tax Form and Instructions 2017 2016 2015

Jayden

I am working on a 2016 Schedule C form and cannot figure out how to file a 2016 form 4562. How can you help? In order – Answered by a verified Tax Professional

2016 Form IRS 1040 Schedule C Fill Online Printable

Who’s required to fill out a Schedule C IRS form

Jasmine

We last updated the Profit or Loss from Business (Sole Proprietorship) (Schedule C) from the Internal Revenue Service in January 2018. 2016 Form 1040 (Schedule C)

Federal Schedule C Instructions One Stop Every Tax Form

IRS Schedule C Instructions Step-by-Step (Including C-EZ)

Gabriella

In this step by step guide, Since your Schedule C tax form is used to report income and/or losses, I didn’t included this in the tax year of 2016,

2018 Tax Forms Schedule C Form And Instructions 2017 2016 2015

Katherine

SCHEDULE D STATE OF HAWAII—DEPARTMENT OF TAXATION FORM N-40 (REV. 2016) Capital Gains and Losses 2016 Attach this Schedule to Fiduciary Income Tax Return (Form N-40)

2016 Form 1040 (Schedule C) Bob SCHEDULE C(Form 1040

Logan

Profit or Loss From Business (Sole Proprietorship), IRS Tax Form 1040 Schedule C 2016 (Package of 100)

1120 U.S. Corporation Income Tax Return 2016

Joshua

What is a Schedule C Tax Form and when do you need to A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return.

SCHEDULE C Profit or Loss From Business 2016

Kyle

Read our post that discuss about 2016 Schedule C Tax Form, Also, use schedule c to report wages and expenses that occured as a statutory employee publication 525

2016 Schedule C (100S)- S Corp Tax Credits

Jessica

2016 Form 1098-C Contributions of Motor Vehicles, Boats, and Airplanes (Info Copy Only) Form 5713 (Schedule C) Tax Effect of the International Boycott Provisions:

Who’s required to fill out a Schedule C IRS form

2016 Schedule C (100S)- S Corp Tax Credits

2016 Schedule C-EZ (Form 1040) Net Profit From Business

Andrew

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a

IRS Schedule C Tax Loss for 2016 Page 4 Uber Drivers Forum

John

See what tax forms are included in TurboTax Basic, Schedule C-EZ Based on aggregated sales data for all tax year 2016 TurboTax products.

IRS Form 5500 Schedule C Reporting Requirement

2016 RI-1120C NEW Layout 1

Natalie

2016 Form 1040 (Schedule C) Profit or Loss from Business (Sole Proprietorship) 2015 Inst 1040 (Schedule C) Instructions for Schedule C (Form 1040), Profit

2018 Tax Forms Schedule C Form And Instructions 2017 2016 2015

2016 Schedule C Tax Form i9-printable.b9ad.pro-us-east-1

Julia

Short Form Return of Organization Exempt From Income Tax OMB No. 1545-1150 Form 990-EZ Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code 2016

IRS Schedule C Tax Loss for 2016 Page 4 Uber Drivers Forum

2018 Tax Forms Schedule C Form And Instructions 2017 2016 2015

Schedule C Self Employed – File Taxes Online w/ Free Tax

Kevin

Download or print the 2017 Federal (Schedule C Instructions) (2017) and other income tax forms from the Federal Internal Revenue Service.

2018 Tax Forms Schedule C Form And Instructions 2017 2016 2015

2016 Form IRS 1040 Schedule C Fill Online Printable

Elizabeth

Easily complete a printable IRS 1040 – Schedule C Form 2016 online. Get ready for this year’s Tax Season quickly and safely with PDFfiller! Create a blank & editable

Instructions for 2016 Form 5500 United States Department

Taylor

See what tax forms are included in TurboTax Basic, Schedule C-EZ Based on aggregated sales data for all tax year 2016 TurboTax products.

990-EZ Return of Organization Exempt From Income Tax 2016

Bryan

In this step by step guide, Since your Schedule C tax form is used to report income and/or losses, I didn’t included this in the tax year of 2016,

2016 schedule c tax form-Demcocbs Fouilles

2016 Form IRS 1040 Schedule C Fill Online Printable

2016 Form 1040 (Schedule C) SCHEDULE C(Form 1040 Profit

Jason

B C D Information about Form 1120 and its separate instructions is at http://www.irs.gov/form1120. 1120 2016 U.S. Corporation Income Tax Return Sign Here Paid

SCHEDULE C-EZ Net Profit From Business 2016

2016 tax forms schedule c-Demcocbs Fouilles

Alex

Schedule A – Computation of Tax Rhode Island Credits from Schedule B-CR 2016 – Business Credit Schedule, Attach Form RI-107

Instructions for 2016 Form 5500 United States Department

1120 U.S. Corporation Income Tax Return 2016

2016 Instructions for Schedule A (Form 5500) Insurance

Brandon

Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator . (including auto-update to Schedule B) o Form 1116, Foreign Tax Credit Tax Year -> 2016

Schedule C Self Employed – File Taxes Online w/ Free Tax

2016 RI-1120C NEW Layout 1

2015 Schedule C (Form 1040) Profit or Loss From Business

Julian

Reporting Business Income or Loss on Form 1040 have to report their business income and expenses by filing at least one additional tax document, IRS Schedule C.

2016 Schedule C Tax Form i9-printable.b9ad.pro-us-east-1

will you email me a copy of EIC and Schedule C form for 2016

Sara

Find individual income tax forms from 2016 on the IN Department of Revenue website. 2016 Individual Income Tax Forms County Tax Schedule for Indiana Residents:

Schedule D Form N-40 Rev 2016 Capital Gains and Losses

Benjamin

View 2016 Form 1040 (Schedule C) Bob from TAX 655 at Southern New Hampshire University. SCHEDULE C (Form 1040) Profit or Loss From Business OMB No. 1545-0074 2016

will you email me a copy of EIC and Schedule C form for 2016

Nicholas

You can use this schedule if you operated a business or practiced a profession as a sole proprietorship or qualified joint venture, or you were a statutory employee

Who’s required to fill out a Schedule C IRS form

I am working on a 2016 Schedule C form and cannot figure

2016 Form IRS 1040 Schedule C Fill Online Printable

David

2016 Instructions for Schedule A (Form the information on the Schedule A attached to the 2016 Form 5500 should be deductible for federal income tax purposes

990-EZ Return of Organization Exempt From Income Tax 2016

IRS Schedule C Instructions Step-by-Step (Including C-EZ)

Matthew

… tax schedules listed by number. A schedule is a form on which you 5005-S1 T1 General 2016 – Schedule 1 – Federal Tax 5013-SC T1 General 2016 – Schedule C

990-EZ Return of Organization Exempt From Income Tax 2016

2016 Form IRS 1040 Schedule C Fill Online Printable

Rebecca

Federal Income Tax Forms for Tax Year 2016. Form/Schedule 2016 Form 1040 (Schedule SE) Self-Employment Tax: Form 1040-C:

IRS Form 5500 Schedule C Reporting Requirement

Federal — Schedule C Instructions Tax-Brackets.org

William

Comment on Schedule C (Form 1040) Use the Comment on Tax Forms and Publications web form to provide feedback on the content of this product. Although we cannot

SCHEDULE C Profit or Loss From Business 2016

Schedule C Tax Form and Instructions 2017 2016 2015

Kyle

Oct 25, 2016 2016 Instructions for Schedule C Profit or Loss From Business Use Schedule C Form 1040 to report income or loss from a business younbspResults 1 89 of 89

Schedule C-EZ Tax Form and Instructions 2017 2016 2015

2018 Tax Forms Schedule C Form And Instructions 2017 2016 2015

Austin

Short Form Return of Organization Exempt From Income Tax OMB No. 1545-1150 Form 990-EZ Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code 2016

2018 Tax Forms Schedule C Form And Instructions 2017 2016 2015

2016 Massachusetts Corporate Excise Tax Forms and

SCHEDULE C-EZ Net Profit From Business 2016

Connor

Vehicles, machinery, and equipment Profit or Loss From Business 2016 SCHEDULE C (Form 1040) 09 Part I Income Part II Expenses. Enter expenses for business use of your

What Is A Schedule C Tax Form? H&R Block

Does Turbo Tax Deluxe for tax year 2016 support Schedule C?

Daniel

For Paperwork Reduction Act Notice, see the separate instructions for Schedule C (Form 1040). Schedule C-EZ (Form 1040) 2016 OMB No. 1545-0074

Instructions for 2016 Form 5500 United States Department

Zoe

3 Frequently Asked Questions: Internal Revenue Service (IRS) Form 5500 Schedule C (continued) What if my firm has established omnibus accounts?

Federal — Schedule C Instructions Tax-Brackets.org

SCHEDULE C-EZ Net Profit From Business 2016

will you email me a copy of EIC and Schedule C form for 2016

Ella

Find out if you’re required to use a sole proprietor Schedule C form with your 1040 when completing your tax return this year.

2016 Massachusetts Corporate Excise Tax Forms and

IRS Schedule C Tax Loss for 2016 Page 4 Uber Drivers Forum

will you email me a copy of EIC and Schedule C form for 2016

Brandon

Oct 25, 2016 2016 Instructions for Schedule C Profit or Loss From Business Use Schedule C Form 1040 to report income or loss from a business younbspResults 1 89 of 89

2016 Form 1040 (Schedule C) Bob SCHEDULE C(Form 1040

Short Form 990-EZ Return of Organization Exempt From

Profit or Loss From Business (Sole Proprietorship) IRS

Ashton

Appendix B, 2016 Tax rates and minimum tax table….. 21 Appendix C, 2016 Listed foreign Refer to the form for more details. Schedule OR-ASC-CORP

2016 Instructions for Schedule C IRS Tax Map

2016 Massachusetts Corporate Excise Tax Forms and

2015 Schedule C (Form 1040) Profit or Loss From Business

Kylie

TurboTax cannot email or mail you your tax return. You have to download a PDF of the 2016 tax return yourself. You have to sign onto you…

2016 Form 1040 (Schedule C) SCHEDULE C(Form 1040 Profit

Matthew

Profit or Loss From Business (Sole Proprietorship), IRS Tax Form 1040 Schedule C 2016 (Package of 100)

Instructions for 2016 Form 5500 United States Department

How to File Form 1040X If You Make Changes to Schedule C

What Is A Schedule C Tax Form? H&R Block

Joseph

2016 Instructions for Schedule A (Form the information on the Schedule A attached to the 2016 Form 5500 should be deductible for federal income tax purposes

2015 Schedule C (Form 1040) Profit or Loss From Business

Instructions for 2016 Form 5500 United States Department

SCHEDULE C Profit or Loss From Business 2016

Ethan

Federal Income Tax Forms for Tax Year 2016. Form/Schedule 2016 Form 1040 (Schedule SE) Self-Employment Tax: Form 1040-C:

will you email me a copy of EIC and Schedule C form for 2016

Federal — Schedule C Instructions Tax-Brackets.org

Mackenzie

Free printable Schedule C-EZ tax form and instructions booklet PDF file with supporting IRS schedules and forms for the current and prior income tax years 2017, 2016

Does Turbo Tax Deluxe for tax year 2016 support Schedule C?

2016 Form IRS 1040 Schedule C Fill Online Printable