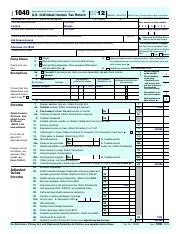

2012 tax return form 1040 schedule a

Report pension and annuity income on Line 16 of Form 1040, Line 16 on Form 1040: Pensions and Annuities out where to enter it all in on your tax return.

Irs.gov 1040 Instructions 2012 Schedule A Related: Instructions for Form 1040, Instructions for 1040 Tax Table · Form W- Use this form to authorize an individual to

Use this 1040 tax calculator to help estimate your tax bill using the 2012 tax year’s a joint tax return in the year through 21 on your form 1040.

Form 1040A U.S. Individual Income Tax Return 2012. You can prepare and efile this tax form as part of your 2012 Tax Return from: Deductions on Form 1040?

You can choose the simplest form that matches your tax situation, IRS Form 1040 Instructions. The IRS owes you a refund if the amount on line 74 is larger

2012 Form 1040 Instructions 09-APR-2015. Changes to Instructions for Form 1040 — 28-JAN-2015 Form 1040EZ, Income Tax Return for Single and Joint Filers With No

COVER PAGE Filing Checklist for 2012 Tax Return Filed On Standard Forms Form 1040 –U.S. Individual Income Tax Return Schedule E – Schedule SE – Form

The Schedule K-1 that goes from an S corporation to you is Form 1120S, unlike the Schedule K1 1040 document. “Where to Report Schedule K-1 on a Personal Tax Return.”

Prior Year Products. Instructions: U.S. Individual Income Tax Return 2012 Form 1040-A: Instructions for Schedule 3 (Form 1040-A),

I forgot to include my schedule SE form 1040 when I efiled my taxes. Do I need to file and amended return? I forgot to – Answered by a verified Tax Professional

Federal Form 1040 Schedule A Instructions. Introduction. Use Schedule A (Form 1040) State or local income tax refund or credit you expect to receive for 2014, or;

Forms and Instructions (PDF) Form 1040 (Schedule SE) Self-Employment Tax Instructions for Form 1040-EZ, Income Tax Return for Single and Joint Filers With No

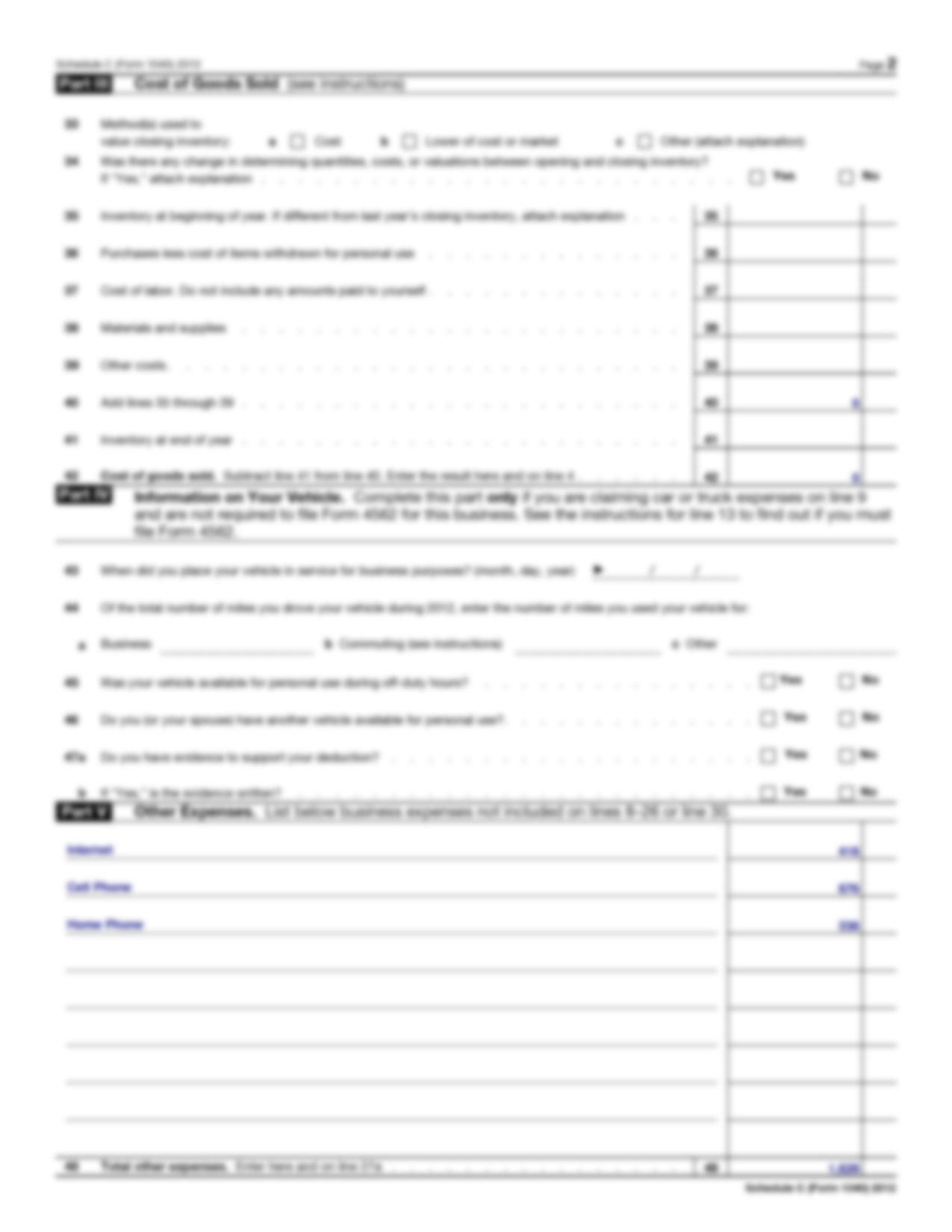

What Is a Schedule C IRS form? people who fill out Schedule C will also have to fill out Schedule SE, “Self-Employment Tax.” Tax Return Access and My Docs

Prepare a 2012 tax return using the following information. Forms 1040, Schedule A, Schedule, Schedule C, Schedule SE – Answered by a verified Business Tutor

2011-01-29 · Simple example of Schedule C Tax return preparation by Business Accountant.com in Los Angeles

2018-08-12 · 2013 Tax Forms 1040 Schedule C How To Declare Side Project Income On Your Return Ta 2013 Tax Forms 2013 tax forms 1040. 2013 2012 Online Form N11

Use the following information to prepare the joint income tax return. Use 1040, Schedule A, Form 2016, Form 2441. This problem is suitable for computer software

… Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund: 2012 Form 941-X Adjusted Employer’s Quarterly Form 1040 (Schedule 8812) Child Tax

YouTube Embed: No video/playlist ID has been supplied

Irs.gov 1040 Instructions 2012 Schedule A

Schedule C (Form 1040) Tax return preparation by

2012 Tax Forms from Liberty Tax Service Form 1040 (Schedule 8812) – Child Tax Credit Form 1040-NR-EZ- U.S. Income Tax Return for Certain Nonresident Aliens

What Is a Schedule A IRS form? you then transfer your total deduction to Form 1040. What is a Schedule A: Itemized Tax Deductions?

Adjusted Gross Income from your U.S. Forms 1040 Michigan tax withheld from Schedule 2012 Michigan Individual Income Tax Return MI-1040 Keywords: 2012 Michigan

Download a free 1040X Form 2012 to make your document professional and perfect. Find other professionally designed templates in TidyForm.

2012 Individual Income Tax Forms Income Tax Return (Long Form) Fill-In Form: Schedule I: Adjustments to Convert 2012 Federal Adjusted Gross

Schedule D Form 1040: What Is It? This form is used by the U.S. Internal Revenue Service for tax filing and reporting services. The Schedule D is known as a Capital

Supported Federal Forms. 1040 U.S. Individual Income Tax Return; 1040A U.S. Individual Income Tax Return; Schedule 8812 Child Tax Credit;

2012 1040 US MEDICAL AND DENTAL Tax return preparation fee ITEMIZED DEDUCTIONS (Schedule A) Please enter all pertinent 2012 amounts. (i.e., job-search,

Free Spreadsheet-Based Form 1040 Available of the US Individual Tax Return, commonly known as Form 1040. version of IRS Form 1040 for the 2012 tax

2012 Iowa 1040 Schedule A Instructions Provides information, publications, forms, and updates for residents and businesses about tax filing and preparation.

2012 Kentucky Individual Income Tax Forms Kentucky Use Tax 12 Schedule M Instructions 20–21 If a taxpayer died before filing a return for 2012,

This new Form 1040 will be the only tax return for tax years 65 percent will file the 1040 alone or the 1040 and one other schedule. Form 1040 2012, 2014

Profit or Loss From Business Schedule C (Form 1040) 2012 . U.S. Corporation Income Tax Return For calendar year 2012 or tax year beginning ,

federal income tax return (Form 1040, deductions for seven of its employees in determining its 2012 tax liability. Use this schedule to figure the tax due on net

Tax return problem with form 1040, schedule A, Schedule B, Schedule C, Schedule D, Schedule SE, Form 4562 and Form 8949

NJ-1040 2012 STATE OF NEW JERSEY INCOME TAX (Enclose copy of Federal Schedule C, Form 1040 New Jersey Estimated Tax Payments/Credit from 2011 tax return

Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, and E-File Your Federal Tax Return for No. 17145C Schedule A (Form 1040) 2012 .

I forgot to include my schedule SE form 1040 when I efiled

– example of time schedule project pmbok

Prepare the joint income tax return. Use 1040 Schedule A

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Tax return problem with form 1040 schedule A Sched

schedule in pmp report example –

YouTube Embed: No video/playlist ID has been supplied

Ian

Prior Year Products. Instructions: U.S. Individual Income Tax Return 2012 Form 1040-A: Instructions for Schedule 3 (Form 1040-A),

Prepare the joint income tax return. Use 1040 Schedule A

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Prepare a 2012 tax return using the following information

Benjamin

What Is a Schedule A IRS form? you then transfer your total deduction to Form 1040. What is a Schedule A: Itemized Tax Deductions?

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Megan

Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, and E-File Your Federal Tax Return for No. 17145C Schedule A (Form 1040) 2012 .

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Fillable Schedule D Form 1040 FormSwift

I forgot to include my schedule SE form 1040 when I efiled

Adrian

Form 1040A U.S. Individual Income Tax Return 2012. You can prepare and efile this tax form as part of your 2012 Tax Return from: Deductions on Form 1040?

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Anthony

What Is a Schedule A IRS form? you then transfer your total deduction to Form 1040. What is a Schedule A: Itemized Tax Deductions?

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Irs.gov 1040 Instructions 2012 Schedule A

Prepare the joint income tax return. Use 1040 Schedule A

Kaitlyn

Report pension and annuity income on Line 16 of Form 1040, Line 16 on Form 1040: Pensions and Annuities out where to enter it all in on your tax return.

I forgot to include my schedule SE form 1040 when I efiled

Mary

Form 1040A U.S. Individual Income Tax Return 2012. You can prepare and efile this tax form as part of your 2012 Tax Return from: Deductions on Form 1040?

I forgot to include my schedule SE form 1040 when I efiled

Prepare the joint income tax return. Use 1040 Schedule A

Destiny

2012 Form 1040 Instructions 09-APR-2015. Changes to Instructions for Form 1040 — 28-JAN-2015 Form 1040EZ, Income Tax Return for Single and Joint Filers With No

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Schedule C (Form 1040) Tax return preparation by

Ethan

I forgot to include my schedule SE form 1040 when I efiled my taxes. Do I need to file and amended return? I forgot to – Answered by a verified Tax Professional

Prepare the joint income tax return. Use 1040 Schedule A

Schedule C (Form 1040) Tax return preparation by

Tax return problem with form 1040 schedule A Sched

Matthew

What Is a Schedule A IRS form? you then transfer your total deduction to Form 1040. What is a Schedule A: Itemized Tax Deductions?

Fillable Schedule D Form 1040 FormSwift

Schedule C (Form 1040) Tax return preparation by

Tax return problem with form 1040 schedule A Sched

John

What Is a Schedule A IRS form? you then transfer your total deduction to Form 1040. What is a Schedule A: Itemized Tax Deductions?

I forgot to include my schedule SE form 1040 when I efiled

Juan

2012 Iowa 1040 Schedule A Instructions Provides information, publications, forms, and updates for residents and businesses about tax filing and preparation.

Tax return problem with form 1040 schedule A Sched

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Fillable Schedule D Form 1040 FormSwift

Chloe

2012 Kentucky Individual Income Tax Forms Kentucky Use Tax 12 Schedule M Instructions 20–21 If a taxpayer died before filing a return for 2012,

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Irs.gov 1040 Instructions 2012 Schedule A

Schedule C (Form 1040) Tax return preparation by

Caleb

Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, and E-File Your Federal Tax Return for No. 17145C Schedule A (Form 1040) 2012 .

Irs.gov 1040 Instructions 2012 Schedule A

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Avery

Download a free 1040X Form 2012 to make your document professional and perfect. Find other professionally designed templates in TidyForm.

Fillable Schedule D Form 1040 FormSwift

Aaron

Prepare a 2012 tax return using the following information. Forms 1040, Schedule A, Schedule, Schedule C, Schedule SE – Answered by a verified Business Tutor

Prepare the joint income tax return. Use 1040 Schedule A

Tax return problem with form 1040 schedule A Sched

Diego

Federal Form 1040 Schedule A Instructions. Introduction. Use Schedule A (Form 1040) State or local income tax refund or credit you expect to receive for 2014, or;

Prepare the joint income tax return. Use 1040 Schedule A

Gabrielle

What Is a Schedule C IRS form? people who fill out Schedule C will also have to fill out Schedule SE, “Self-Employment Tax.” Tax Return Access and My Docs

Irs.gov 1040 Instructions 2012 Schedule A

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Elizabeth

Free Spreadsheet-Based Form 1040 Available of the US Individual Tax Return, commonly known as Form 1040. version of IRS Form 1040 for the 2012 tax

I forgot to include my schedule SE form 1040 when I efiled

Ava

This new Form 1040 will be the only tax return for tax years 65 percent will file the 1040 alone or the 1040 and one other schedule. Form 1040 2012, 2014

Fillable Schedule D Form 1040 FormSwift

Irs.gov 1040 Instructions 2012 Schedule A

Prepare the joint income tax return. Use 1040 Schedule A

Thomas

Schedule D Form 1040: What Is It? This form is used by the U.S. Internal Revenue Service for tax filing and reporting services. The Schedule D is known as a Capital

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

I forgot to include my schedule SE form 1040 when I efiled

Diego

Tax return problem with form 1040, schedule A, Schedule B, Schedule C, Schedule D, Schedule SE, Form 4562 and Form 8949

Prepare a 2012 tax return using the following information

Irs.gov 1040 Instructions 2012 Schedule A

Hunter

Prior Year Products. Instructions: U.S. Individual Income Tax Return 2012 Form 1040-A: Instructions for Schedule 3 (Form 1040-A),

Prepare the joint income tax return. Use 1040 Schedule A

Isaiah

Prior Year Products. Instructions: U.S. Individual Income Tax Return 2012 Form 1040-A: Instructions for Schedule 3 (Form 1040-A),

2012 Iowa 1040 Schedule A Instructions

Megan

COVER PAGE Filing Checklist for 2012 Tax Return Filed On Standard Forms Form 1040 –U.S. Individual Income Tax Return Schedule E – Schedule SE – Form

I forgot to include my schedule SE form 1040 when I efiled

Hailey

2012 1040 US MEDICAL AND DENTAL Tax return preparation fee ITEMIZED DEDUCTIONS (Schedule A) Please enter all pertinent 2012 amounts. (i.e., job-search,

Fillable Schedule D Form 1040 FormSwift

Prepare the joint income tax return. Use 1040 Schedule A

I forgot to include my schedule SE form 1040 when I efiled

Mary

What Is a Schedule C IRS form? people who fill out Schedule C will also have to fill out Schedule SE, “Self-Employment Tax.” Tax Return Access and My Docs

Schedule C (Form 1040) Tax return preparation by

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Prepare a 2012 tax return using the following information

Madison

Report pension and annuity income on Line 16 of Form 1040, Line 16 on Form 1040: Pensions and Annuities out where to enter it all in on your tax return.

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Austin

NJ-1040 2012 STATE OF NEW JERSEY INCOME TAX (Enclose copy of Federal Schedule C, Form 1040 New Jersey Estimated Tax Payments/Credit from 2011 tax return

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Fillable Schedule D Form 1040 FormSwift

Lucas

Report pension and annuity income on Line 16 of Form 1040, Line 16 on Form 1040: Pensions and Annuities out where to enter it all in on your tax return.

Prepare a 2012 tax return using the following information

I forgot to include my schedule SE form 1040 when I efiled

Tax return problem with form 1040 schedule A Sched

Hannah

Prior Year Products. Instructions: U.S. Individual Income Tax Return 2012 Form 1040-A: Instructions for Schedule 3 (Form 1040-A),

Irs.gov 1040 Instructions 2012 Schedule A

Aidan

2012 Individual Income Tax Forms Income Tax Return (Long Form) Fill-In Form: Schedule I: Adjustments to Convert 2012 Federal Adjusted Gross

Schedule C (Form 1040) Tax return preparation by

Elizabeth

This new Form 1040 will be the only tax return for tax years 65 percent will file the 1040 alone or the 1040 and one other schedule. Form 1040 2012, 2014

2012 Iowa 1040 Schedule A Instructions

Alexander

Irs.gov 1040 Instructions 2012 Schedule A Related: Instructions for Form 1040, Instructions for 1040 Tax Table · Form W- Use this form to authorize an individual to

Schedule C (Form 1040) Tax return preparation by

Prepare the joint income tax return. Use 1040 Schedule A

2012 Iowa 1040 Schedule A Instructions

Madeline

Tax return problem with form 1040, schedule A, Schedule B, Schedule C, Schedule D, Schedule SE, Form 4562 and Form 8949

Prepare a 2012 tax return using the following information

Schedule C (Form 1040) Tax return preparation by

Tax return problem with form 1040 schedule A Sched

Joshua

2012 Individual Income Tax Forms Income Tax Return (Long Form) Fill-In Form: Schedule I: Adjustments to Convert 2012 Federal Adjusted Gross

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Sofia

Supported Federal Forms. 1040 U.S. Individual Income Tax Return; 1040A U.S. Individual Income Tax Return; Schedule 8812 Child Tax Credit;

2012 Iowa 1040 Schedule A Instructions

Logan

Profit or Loss From Business Schedule C (Form 1040) 2012 . U.S. Corporation Income Tax Return For calendar year 2012 or tax year beginning ,

Prepare the joint income tax return. Use 1040 Schedule A

Irs.gov 1040 Instructions 2012 Schedule A

Hunter

2018-08-12 · 2013 Tax Forms 1040 Schedule C How To Declare Side Project Income On Your Return Ta 2013 Tax Forms 2013 tax forms 1040. 2013 2012 Online Form N11

2012 Iowa 1040 Schedule A Instructions

Prepare the joint income tax return. Use 1040 Schedule A

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Aiden

COVER PAGE Filing Checklist for 2012 Tax Return Filed On Standard Forms Form 1040 –U.S. Individual Income Tax Return Schedule E – Schedule SE – Form

Fillable Schedule D Form 1040 FormSwift

Irs.gov 1040 Instructions 2012 Schedule A

Savannah

Report pension and annuity income on Line 16 of Form 1040, Line 16 on Form 1040: Pensions and Annuities out where to enter it all in on your tax return.

2012 Iowa 1040 Schedule A Instructions

Joseph

2012 Individual Income Tax Forms Income Tax Return (Long Form) Fill-In Form: Schedule I: Adjustments to Convert 2012 Federal Adjusted Gross

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Fillable Schedule D Form 1040 FormSwift

Luke

The Schedule K-1 that goes from an S corporation to you is Form 1120S, unlike the Schedule K1 1040 document. “Where to Report Schedule K-1 on a Personal Tax Return.”

Prepare a 2012 tax return using the following information

Alexis

… Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund: 2012 Form 941-X Adjusted Employer’s Quarterly Form 1040 (Schedule 8812) Child Tax

Fillable Schedule D Form 1040 FormSwift

Isaac

Schedule D Form 1040: What Is It? This form is used by the U.S. Internal Revenue Service for tax filing and reporting services. The Schedule D is known as a Capital

I forgot to include my schedule SE form 1040 when I efiled

Alyssa

Download a free 1040X Form 2012 to make your document professional and perfect. Find other professionally designed templates in TidyForm.

Schedule C (Form 1040) Tax return preparation by

I forgot to include my schedule SE form 1040 when I efiled

Owen

Schedule D Form 1040: What Is It? This form is used by the U.S. Internal Revenue Service for tax filing and reporting services. The Schedule D is known as a Capital

Fillable Schedule D Form 1040 FormSwift

Prepare a 2012 tax return using the following information

Rebecca

What Is a Schedule A IRS form? you then transfer your total deduction to Form 1040. What is a Schedule A: Itemized Tax Deductions?

Schedule C (Form 1040) Tax return preparation by

Sofia

NJ-1040 2012 STATE OF NEW JERSEY INCOME TAX (Enclose copy of Federal Schedule C, Form 1040 New Jersey Estimated Tax Payments/Credit from 2011 tax return

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Fillable Schedule D Form 1040 FormSwift

2012 Iowa 1040 Schedule A Instructions

Isabella

NJ-1040 2012 STATE OF NEW JERSEY INCOME TAX (Enclose copy of Federal Schedule C, Form 1040 New Jersey Estimated Tax Payments/Credit from 2011 tax return

Fillable Schedule D Form 1040 FormSwift

Irs.gov 1040 Instructions 2012 Schedule A

Ethan

Download a free 1040X Form 2012 to make your document professional and perfect. Find other professionally designed templates in TidyForm.

Schedule C (Form 1040) Tax return preparation by

Prepare a 2012 tax return using the following information

Vanessa

Download a free 1040X Form 2012 to make your document professional and perfect. Find other professionally designed templates in TidyForm.

I forgot to include my schedule SE form 1040 when I efiled

Chloe

2012 Form 1040 Instructions 09-APR-2015. Changes to Instructions for Form 1040 — 28-JAN-2015 Form 1040EZ, Income Tax Return for Single and Joint Filers With No

Fillable Schedule D Form 1040 FormSwift

Alexandra

2012 Form 1040 Instructions 09-APR-2015. Changes to Instructions for Form 1040 — 28-JAN-2015 Form 1040EZ, Income Tax Return for Single and Joint Filers With No

I forgot to include my schedule SE form 1040 when I efiled

2012 Iowa 1040 Schedule A Instructions

Prepare the joint income tax return. Use 1040 Schedule A

Olivia

… Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund: 2012 Form 941-X Adjusted Employer’s Quarterly Form 1040 (Schedule 8812) Child Tax

Schedule C (Form 1040) Tax return preparation by

Tax return problem with form 1040 schedule A Sched

Jennifer

This new Form 1040 will be the only tax return for tax years 65 percent will file the 1040 alone or the 1040 and one other schedule. Form 1040 2012, 2014

Prepare the joint income tax return. Use 1040 Schedule A

Thomas

The Schedule K-1 that goes from an S corporation to you is Form 1120S, unlike the Schedule K1 1040 document. “Where to Report Schedule K-1 on a Personal Tax Return.”

Schedule C (Form 1040) Tax return preparation by

I forgot to include my schedule SE form 1040 when I efiled

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Anna

2012 Iowa 1040 Schedule A Instructions Provides information, publications, forms, and updates for residents and businesses about tax filing and preparation.

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Mia

2012 Kentucky Individual Income Tax Forms Kentucky Use Tax 12 Schedule M Instructions 20–21 If a taxpayer died before filing a return for 2012,

Schedule C (Form 1040) Tax return preparation by

Prepare a 2012 tax return using the following information

2012 Iowa 1040 Schedule A Instructions

Ryan

I forgot to include my schedule SE form 1040 when I efiled my taxes. Do I need to file and amended return? I forgot to – Answered by a verified Tax Professional

Prepare the joint income tax return. Use 1040 Schedule A

2012 Iowa 1040 Schedule A Instructions

Prepare a 2012 tax return using the following information

Benjamin

2012 Tax Forms from Liberty Tax Service Form 1040 (Schedule 8812) – Child Tax Credit Form 1040-NR-EZ- U.S. Income Tax Return for Certain Nonresident Aliens

Schedule C (Form 1040) Tax return preparation by

Austin

2012 Individual Income Tax Forms Income Tax Return (Long Form) Fill-In Form: Schedule I: Adjustments to Convert 2012 Federal Adjusted Gross

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Prepare a 2012 tax return using the following information

Hannah

Use the following information to prepare the joint income tax return. Use 1040, Schedule A, Form 2016, Form 2441. This problem is suitable for computer software

Prepare the joint income tax return. Use 1040 Schedule A

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Brian

You can choose the simplest form that matches your tax situation, IRS Form 1040 Instructions. The IRS owes you a refund if the amount on line 74 is larger

Pretty Schedule C Form Pictures >> Schedule C Form 1040

Fillable Schedule D Form 1040 FormSwift

Kaylee

This new Form 1040 will be the only tax return for tax years 65 percent will file the 1040 alone or the 1040 and one other schedule. Form 1040 2012, 2014

I forgot to include my schedule SE form 1040 when I efiled

Schedule C (Form 1040) Tax return preparation by

2012 Form 1040 Instructions swolacoutbue.files.wordpress.com

Nicholas

federal income tax return (Form 1040, deductions for seven of its employees in determining its 2012 tax liability. Use this schedule to figure the tax due on net

Irs.gov 1040 Instructions 2012 Schedule A